Reducing Your Tax Liability

Need Tax Relief?

Call Now – Free Consultation 866-477-5291

You May Not Owe So Much Income Taxes

Contrary to claims made by unscrupulous marketing companies masquerading as legitimate tax resolution firms, the principle debt that you truly owe the IRS cannot be reduced. Under certain circumstances, the IRS may settle for less through an Offer in Compromise. However, if you have unfiled returns dating back two years or more, there may be another way to reduce the principle debt that the IRS “claims” you owe.

Most people do not know that if you do not file a tax return, the IRS will wait approximately 2 years to file a tax return for you. The created tax return is called a “Substitute for Return.” When the IRS files this type of tax return for you, they do not take into account any of your deductions, dependents, write-offs or exemptions that you may be eligible to claim. In other words, you are not getting “your day in court” to defend yourself. In almost all cases, these Substitute Returns will grossly inflate you tax debt.

As an example, if you sold stock or bonds prior to 2011, the brokerage filed a report with the IRS. It only reports the total sales price and does not list your cost basis (how much you paid for the stock). If you are a business owner or are self-employed, the IRS does not include any business-related expenses that are tax deductible. If you paid mortgage interest, you lose that deduction. If you had un-reimbursed employee expenses, a casualty loss or high medical expenses, you lose those.

The IRS then takes the total gross income reported to them, applies one single exemption, and then uses that as your taxable income figure. As a result, the IRS will assign an inflated tax debt against your social security number and quickly start the collections process. The IRS may also report this inflated Adjusted Gross Income to your state tax authority. Then they will also use these inflated numbers to prepare substitute returns. In many instances, the inflated income figure places you into a higher tax bracket, resulting in an even higher tax bill. The only way to reduce this tax debt is by filing your true returns over the IRS substitutes.

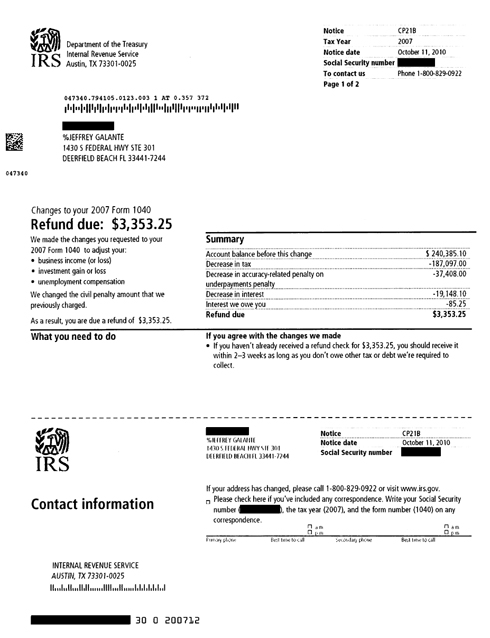

It is your right as a citizen to have Tax Litigation Associates file a true tax return on your behalf to replace the Substitute for Return that the IRS filed for you. Once the IRS receives and processes your new tax return, they will void the one they originally created. By law, the IRS must allow you to file over these Substitute Tax Returns. The IRS then zeroes out the debt and will calculate the tax, penalties and interest based on your new and true return. In many cases, the outcome is little or no debt, and there may even be a refund coming to you! If the IRS owes you a refund, they will place it against any outstanding debt and send you a refund for the rest.

Fortunately for taxpayers, Tax Litigation Associates can prepare multiple years of tax returns in a matter of days. Tax Litigation Associates can help you prepare proper returns and make sure you do not pay the IRS $1 more than is necessary. IRS collections is under no obligation to explain your rights. Their primary goal is to collect the debt. Technically speaking, you can leave the IRS Substitute Return as is. But in nearly every case, it is beneficial to file your own true tax return.

Do not fall victim to IRS persuasion. Do yourself a favor and call Tax Litigation Associates to determine the best way to handle your case.

Below you will find some examples of actual results we got for our clients and how re-filing tax returns can dramatically lower your tax debt.